Table of Contents

ToggleAre earn near to ₹35000 in a month? And if you are curious about, how someone earning in less monthly income can buy a car without loan? — No EMI, No interest, No bank hassles! — in this content, the simple guide is for you. It’s based on a real-life example from the content of India Today that shows, buying a car with loan is possible if someone having regular savings, side income, and discipline.

Positives of Buying a Car Without Loan?

There are huge positives in buying a car without loan. Point wise all positives are mentioned:

Zero interest, zero EMI: So, you pay only the car price — no extra cost as interest.

Full ownership & flexibility: If you buy a car with loan then loan company have the half right in your car if you foul the loan or sell and also in the RC the hypothecation also made in the name of loan company. Buying a car without loan you don’t have the hassles like this.

Peace of mind: No debt, No financial stress which keeps your future options open.

Better negotiation power: If you have all the money of buying a car in your pocket then you have a positive side to have a good bargain power, dealer sees you are ready to buy the car if not getting good offer customer can diverted to other dealer.

Real Story: Buying a Car without Taking Loan or any other type of Debt

-

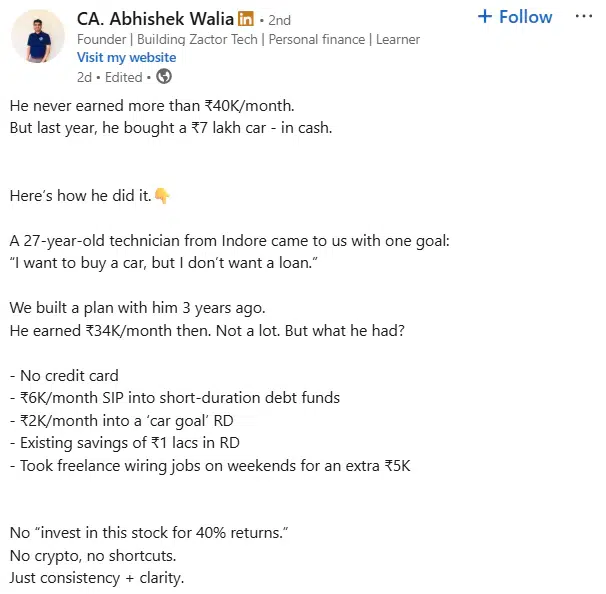

A 27‑year‑old technician from Indore, planning to buy a car with no loan or any other debt from market and the monthly income of the technician is Rs. 34000.

-

The technician don’t have any credit cards.

-

He already had ₹1 lakh in a Recurring Deposit (RD) dedicated for the car.

-

Each month for three straight years, he saved:

-

₹6,000 into a short-term debt mutual fund

-

₹2,000 into a recurring deposit earmarked for the car.

-

-

He also earned an extra ₹5,000 monthly from weekend freelance wiring jobs.

-

After three years of continue saving in the funds and RDs with full of discipline and patience his total car fund reached to:

-

₹2.5 lakh from mutual funds

-

₹2.1 lakh from RD

-

₹2 lakh from side income (weekly freelancing income)

-

₹50,000 bonus for Diwali

-

₹10,000 from an old scooter sale

-

-

Grand total → ₹7.1 lakh in cash, enough to drive off without a loan.

-

CA Abhishek Walia, who advised him, wrote on LinkedIn:

“He never earned more than Rs 40K/month. But last year, he bought a Rs 7 lakh car – in cash. Here’s how he did it.”

-

His mantra: “No crypto. No share‑market shortcuts. Just clarity and consistency.”

DIY or Lesson Learnt form Car without Loan blueprint

| Step | What to do |

|---|---|

| Set a goal | Pick your dream car and calculate its on-road price. for example: ₹7 lakh |

| Divide & fund | Automate your savings ₹6k–₹10k/month into safe instruments like low‑duration debt funds or RDs. |

| Add side earnings | Earn an extra ₹3–₹5k/month as per your expertise. |

| Skip bad habits | Forget credit cards and EMIs. Redirect that monthly amount into your car fund. |

| Track & reward | Use a ledger to track progress. Celebrate every milestone. |